The six nations of the Gulf Cooperation Council - Saudi Arabia, Kuwait, Bahrain, Omar, Qatar, and the UAE, earned US$381 bln from oil exports in 2007. Oil export revenues earned by member countries of OPEC are set to reach a record total of over US$1 trillion by the end of 2008 and continue on an upward trend into 2009, according to estimates by the U.S. Energy Information Administration. In the first seven months of 2008, OPEC members earned a record US$642 billion for oil exports. A lot of that money is flowing into infrastructure. From Dubai to Kuwait, there's an estimated US$2.4 trillion in construction projects either underway or in development in the world's biggest oil patch. Surprisingly, US$1.4 trillion of that total is for projects in civil construction. This means spending on residential and commercial construction projects in the Middle East outweighs construction on oil, gas, power, petrochemical, industrial, and water projects combined.

The rapid infrastructure development in the Middle East region drives the markets of pipe systems from water and sewage to cooling systems and industrial pipes. In addition, existing pipe systems are prone to leaking valuable water resources and need to be upgraded. The Middle East region offer challenges including conditions of extreme temperatures, wind and sand erosion which ultimately take its toll on the piping systems. Saudi Arabia’s King Saud University has done extensive research in this particular area.

Development of infrastructure in the Middle East has been a regional focus for international organisations like the World Bank and the IMF. This region has been relatively underinvested with a large portion of the rural population being completely unserved by electricity and telecommunications, while services in urban areas often experience high distribution losses, frequent service interruptions, and weak financial performance. Infrastructure development is not only crucial in meeting the region’s social challenge, but has an essential contribution to make towards improving business competitiveness in the Middle East.

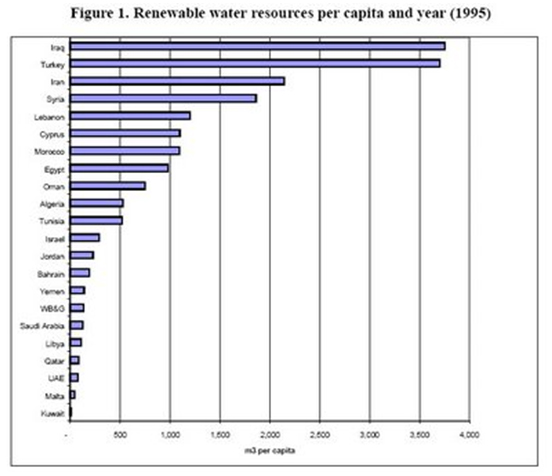

Infrastructure mean public infrastructure, which can be classified into water, electricity, transport, sewerage, telecommunications, sanitation. Given that the region is now characterised by high monetary inflows and a rapidly growing population that has more than doubled to about 270 mln in the past 30 years, could double again in the next 30 years recording an annual growth rate of approx 2.5%), the growth in infrastructure investments will obviously outperform most other areas of the world. The water sector is a unique problem to the Middle East more than anywhere else, and it is evident from an examination of demand and supply. In terms of supply, the water availability per capita is historically the lowest among all the world's major regions, and this is expected to remain similar in the future.

Among the various Middle-East countries, the rich Gulf countries are the ones that lack renewable (ie. natural) water the most: Bahrain, Saudi Arabia, UAE, Qatar, Kuwait, implying that these countries offer the greatest opportunities for water infrastructure development.

On the demand side, many Middle-East countries have some of the highest consumption rates per capita in the world (in UAE, consumption per capita is more than 3X the world average). High consumption rates are mainly driven by aggressive agricultural policies, which can account for >80% of a country's water usage, and further accentuated by high technical and commercial losses in the water systems, also referred to as unaccounted for water(UFW). Kuwait, Saudi Arabia and the UAE actually provide water for free.

Approaches to increasing water supply (over and above natural/renewable water sources) include tapping into groundwater, desalinating seawater, or by reusing wastewater. The first poses long-term environmental problems, the third only allows limited usage of the recycled water; the second option is expensive but is the top technological approach for increasing water supplies in the region for the richer countries, and is practised on a large scale in Saudi Arabia and in the Gulf countries (esp. UAE & Kuwait), where it contributes substantially to municipal and industrial water supplies. The Middle East nations operate 60% of the world's desalination plants, and it is estimated they will need to invest a $100 billion on desalination over the next decade if demand for water keeps growing at the current pace, especially in the Gulf region. To give a perspective, water infrastructure is probably the third most important infrastructural investment in Saudi Arabia for the coming years (US$80B over the next 20 years), after oil and gas (to be covered in a separate article) and electricity.

The second sub-sector is electricity and power. The IMF’s prediction is that the regional power sector will remain very buoyant for the coming year, in contrast to other parts of the world where demand is stagnant or growing slowly. This is due to continued strong regional economic growth. Demand in these richer GCC (Gulf Cooperation Council) countries is expected to experience double digit growth in the foreseeable future. In addition, reconstruction of Iraq’s electricity generation and distribution sector also provides promise. Recent estimates are that US$57 billion will be spent over the next six years in the Middle East & North African region on the installation of new capacity alone. where about half of this will be spent solely in the GCC (the richer Gulf countries), with the private sector to provide the majority of this. Among these, Saudi Arabia and the UAE are expected to provide the bulk of the contracts.

An overview of the current/future power/electricity investments as of early 2006:

| • |

Different sectors within the energy industry in the Middle East will require investments of more than $1 trillion over the next 20 years. |

| • |

The UAE's power sector needs more than $10 billion investment to meet growing energy consumption demand. |

| • |

The government of Saudi Arabia plans to increase generation capacity from 17,000MW to 66,000MW by 2023, requiring investments of $17 billion |

| • |

Investments required in other Middle East countries are estimated to be: $3.6 billion in Kuwait; $800 million in Oman; and $1 billion in Bahrain |

| Projected Additional Capacity needed by 2010 |

| Bahrain |

1200MW at an estimated cost of US$900 million |

| Iran |

20,000MW at an estimated cost of US$10 billion |

| Jordan |

750MW at an estimated cost of US$445 million |

| Kuwait |

3,400MW at an estimated cost of US$2.5 billion |

| Lebanon |

350MW at an estimated cost of US$175 million |

| Oman |

1,100MW at an estimated cost of US$900 million |

| Qatar |

800MW at an estimated cost of US$600 million |

| Saudi Arabia |

20,000MW at an estimated cost of US$15 billion |

| United Arab Emirates |

6,600MW at an estimated cost of US$5.1 billion |

These power/electricity generation projects tend to be huge. An example is the Dolphin Project, which involves the production and processing of natural gas from Qatar’s North Field, and transportation of the dry gas by pipeline to the UAE for electricity generation. Intended to fuel the UAE’s long-term industrial growth, it is worth billions of dollars. Another significant project is the GCC power grid : a US$3 bln project, which is intended to serve as a common power grid to join the GCC nations: Saudi Arabia, Kuwait, Bahrain, Qatar, the UAE and Oman.

(http://hottrendswatch.blogspot.com/2006/09/middle-east-series-infrastructure.html)

There are around 120 producers of large diameter pipes worldwide and the market is moving to Asia and the Middle East. There are around 720 companies in Iran producing PE pipes and fittings for water, gas and sewage. PE is in strong competition with glass-reinforced plastic (GRP) and steel. The GRP pipe market is growing rapidly. Owing to their corrosion resistance, strength and lightweight giving them a competitive advantage over traditional materials. In some cases, carbon black is added to pipe compounds to improve UV-resistance and to give antistatic properties to gas pipes. The major material suppliers to the piping industry in the Middle East region include SABIC, Dow, LyondellBasell, Total and others. SABIC is a major supplier of bimodal PE for pressure pipes in the Middle East. SABIC’s Vestolen A PE 100 pipe grades offers good resistance to stress crack growth and crack propagation, durability and a long lifetime in service. Like other suppliers, SABIC would like to see the development of local performance standards for plastics pipes considering that the low quality products have been damaging the market image in the region. SABIC earlier used its Vestolen A 6060R grade in a huge project in Europe where the need was to eliminate the untreated wastewater problem it was decided to install a pipeline system based on polyethylene along the Portuguese Atlantic coast. This project comprised of an inland pipeline system of 6.6 km length which was to collect the wastewater and an outfall of 2.2 km length to discharge the wastewater into the Atlantic Ocean. The engineers designed the outfall for a maximum daily wastewater volume of 31 mln litres.

Total Petrochemicals has a new low sagging PE 100 material for thick walled pressure pipes. All Total Petrochemicals’ coloured Polyethylene pipe compounds including PE 100 are made exclusively with hexene as comonomer. Compared to standard PE resins for pipe, the use of hexene as comonomer leads to better slow crack growth resistance, sturdy resistance against rapid crack propagation and more importantly, superior melt strength (low sag).

Dow Chemical has its range of DOWLEX™ PE-RT (Polyethylene of Raised Temperature Resistance) material from with improved higher temperature performance. It can be used in more aggressive environments of extreme temperatures.

LyondellBasell also manufactures PP block copolymers for sewage and drainage pipes. LyondellBasell's joint ventures in the Middle East will up the ante for polyolefins production which will certainly benefit the pipe applications market. High density polyethylene resins will be sourced from the new world-scale Hostalen ACP plant, jointly owned by LyondellBasell and Tasnee, and polypropylene resins will be provided by Al Waha's Spherizone PP plant. Rehau uses LyondellBasell’s PP copolymer material for solid wall sewage pipes and profile walled pipes by Frank, Gigapipe and Plomyplas among others. The pipes have high impact strength, high ring stiffness and good resistance to chemicals such as hydrogen sulphide. Recently, LyondellBasell launched a new polyethylene adhesive resin to address customer needs in the rapidly-expanding pipe coatings industry. The new resin, Lucalen G3710E, is used as an adhesive layer in three-layer coating applications between fusion bonded epoxy resins and an HDPE top coat material. The new resin is a part of company’s differentiated pipe coating portfolio which includes also Lupolen 4552D SW00413 HDPE top coat material and PP-based coating products typically used for anti-corrosion coating, mechanical protection and thermal insulation on oil, gas and water transportation pipelines.

Saudi Arabian Company—Amiantit is one of the world’s largest manufacturers of pipe systems. The Groups Pipe Systems division comprises almost 30 wholly-owned, majority-owned or joint-venture manufacturing facilities in 18 countries. The company is a leading supplier of GRP pipes worldwide and has supplied 7500 km of GRP piping in the Middle East region.

Crosslinked polyethylene (PEX) is rapidly penetrating into the plumbing market and avoids issues such as theft of valuable copper pipe. The installation of PEX pipes are easy to install and take less time. PEX can lessen the number of fittings in the plumbing system and offer large number of variations. Uponor anticipates that crosslinked polyethylene (PEX) will hold more than 75% of the European market for radiant thermal conditioning pipes in 2010. The pipes are embedded in the building structure for heating or cooling, reducing the size of the system.

PVC pipes came into use in the 1970s. In the Middle East, more than 85% of the PVC consumption is in the construction industry and further growth is forecast in sewage, drainage and telecommunication pipes in most countries. Egyptian company, Misr Elhegaz Group is a leading group in the region for production of PVC pipes. Rohm and Haas has developed a new lead-free stabilization system based on mercaptan chemistry which has been used for decades with conventional tin stabilizers. The patented technology includes organic based, heavy metal free compositions that contain blocked thiols, which under vinyl processing conditions generate highly effective stabilizing components. This new stabilizing systems are non toxic, without any heavy metals available as stabilizing additives with good price-performance ratio. This new technology is an advanced and more sustainable solution for PVC pipes stabilization.

Amidst the infrastructure boom in Middle East, the region requires extensive pipe renewal and construction to safeguard water supplies and support burgeoning industry and community development. With effective quality control in materials, production, transport and installation, plastic pipes markets will certainly surge in Middle East in the future.