The Indian label industry is complex, dynamic and fast growing. Although per capita consumption of labels in India is the lowest in any analysed region, it also has the highest growth rate in the world at 19%. In India, wet glue labels although still growing in double digits, are fast making way for pressure sensitive and flexible film labels. Bar-coded labels are growing by 30-35% in India, but are making way for smart RFID labels in Europe and USA. Narrow web flexo and combination presses are growing in India as compared with growth of digital label presses in the advanced countries.

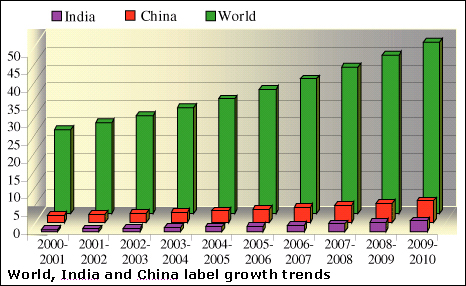

Global growth trends are estimated variously from 5% by Gallus to 7% by Fredonia from 2000-2005. As per Ippstar Printing Industry Survey, world label production growth is estimated in sq.mtrs. at 8% from 2000-2005 and 8.5% from 2005-2010. These estimates are based on the continued increase of wet glue labels in rapidly growing Asian markets and the more rapid growths of both pressure sensitive and flexible labels.

Ippstar expects Asia Pacific’s share to rise from 34% in 2000-2001 to 38% in 2004-05 and to 45% in 2009-2010, despite being held down by Japan’s growth of around 3%. China and India will lead the increase in Asia’s label production share with China achieving 12.6% of world label production and India achieving 6.3% of world production of all types of labels in 2009-2010 in sq mtrs.

Rate of label production in sq.mtrs. is rising faster in India than China. In 2002-03, India's production of labels in sq.mtrs. was just above 30% that of China, and is expecte dto increase to 50% of China's prodcution by 2009-10. . However, the gap between Chinese and Indian label production will increase to 3 bln sq.mtrs. by then. The only way that Indian label manufacturers can surpass China is in value- by the production of very high value labels that are directly exported, and by rapid adoption and market leadership in smart and RFID labels where they will have to take on or partner the Americans.

Each segment of the printing industry is fragmented, and contains organised and small and disorganised players. And although the industry as a whole is growing at more than twice the GDP growth rate, the packaging industry contains a larger number of organised players than almost any other segment other than publishers. Packaging growth in India has grown from 26% of the printing industries in 1999 to about 34% of the total turnover of the industry. In 2002-2003, the packaging industry in India which includes glass, metal and plastic rigid and semi-rigid packaging, flexible, corrugated, and board packaging, was valued at Rs.18,000 crore (approx US$ 4 bln). Within the packaging segment, flexible packaging outstrips growth of board and other kinds of packaging but the fastest growth in the segment comes from all kinds of labels.

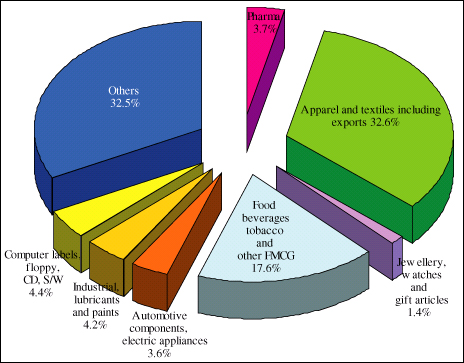

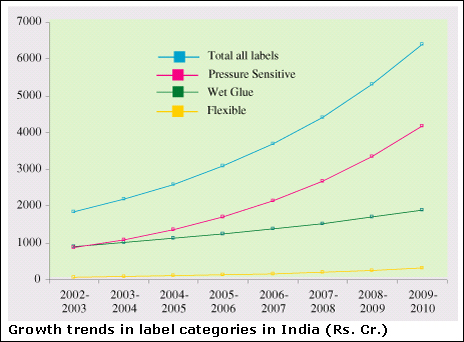

The geographic distribution of most segments using labels is 31% in the North, 28% in the West, 26% in the South and 15% in the East. Production of labels is still highest in the West, but label manufacturers in both the South and the North are adding capacity and gaining ground. Western India with its strong textile, engineering and FMCG manufacturing base has the largest packaging and label industry as well. The region is adding the highest number of sophisticated narrow web label presses and it has the most number of organised label manufacturers. It also has the largest number of label exporters. Size of the label industry including wet glue, pressure sensitive (including holograms), flexible and wraparound labels in 02-03 was Rs. 1842 crore, with growth trends of 11 to 25% with an average growth rate - slightly more than 19% to 2009-2010. By 2009-2010 the Indian label industry is forecast to reach Rs. 6400 crore (US$ 1.4 bln).

Within pressure sensitive labels, the use of transparent and filmic labels is the hot segment. However the fastest growing flexible label segment consists of wraparound and shrink-wrap labels. Shrink-wrap labels are most popular in the Indian packaging market as FMCG manufacturers use them to cover irregular shaped rigid containers. Flexible labels printed by gravure and flexography are increasing at more than 25% pa from a small base of Rs 68 crore in 02-03 to at least 324 crore in 09-10. Wet glue will decline in India to about 30% of label production by value in 2009-10, while pressure sensitive labels will rise to 65% and flexible labels will go from less than 4% to more than 5%. The growth of flexible could be higher because of the increased use of multicolor wrap-around labels but similarly the growth of pressure sensitive labels will be enhanced by the increasing value of smart labels. Flexible packaging will continue to erode the share of rigid containers with labels, as seen in the food processing sector. In this sector there has been an introduction of in-mould labeling as well but it is too small to enumerate at this point.

Consumption of pressure sensitive label stock in India should rise from 266 mln sq.mtrs. in 02-03 to 1.3 bln sq.mtrs. in 2009-10 with a growth rate close to 20%. What is significant in this growth trend projection is that in sq.mtrs. India will triple its market share from 1.8% of the world’s pressure sensitive labels in 02-03, to 5.3% in 2009-10. The label industry has now reached the inflection point for moderately high growth on a small base, and with this kind of capacity creation one can expect a CAGR of at least 19% over several years. There is also the opportunity and the need to aim for 25% growth because this industry is still small and because it can be technology and export driven.

Wet glue has been dominant in India because of its obvious ease of production and simplicity in application. Nevertheless wet glue labels although huge in quantity and with continued double-digit growth were overtaken in value (but not in quantity) by pressure sensitive labels in 2003-04. On the other hand the flexible shrink and wraparound labels are the highest growth segment of the label industry (more than 24-25%) but this growth is on a small base. Modern consumer product marketing believes that the product packaging and the label have to be attractive enough to sell the product on their own. This requires the high value addition that is associated with the pressure sensitive segment and especially its new varieties such as clear see-through pressure sensitive and in some case with shrink-wrap labels. It is estimated that flexible labels, pressure sensitive and wraparound and shrink-wrap labels, will rapidly take away market share from paper-based labels.

Three important growth segments of the economy for packaging are the food and beverage industry, the pharmaceutical industry and the textile and apparel industry. The total food market in India was Rs. 3,30,000 crore or US$71.7 bln in 2003. Out of this figure Rs 80,000 crore (US$17.4 bln) consisted of processed or value added food products. The Indian pharmaceutical industry in 2002-2003 was of the order of Rs 26,000 crore (US$5.7 bln). The apparel industry in India was Rs. 128,800 crore (US$ 28 bln). The entire Indian FMCG market is Rs 60,000 crore which is (US$13 bln).

Out of the Rs. 128,800 crore (US$28 bln) apparel industries, the organised retail component is about Rs. 9,000 crore or less than US$2 bln, in addition to the US$13 bln textile exports. These are evenly divided between apparel and textile made-ups. This industry consumes about 2.5% of its costs in packaging, about US$325 mln or only Rs. 1,495 crore. Half of this is spent is spent on printed polybags and shipping materials including cartons and the remaining 50% is spent on labels and tags. The label component is in fact 10% with the remaining 40% for tags. Thus one can estimate that labels get only Rs. 149 crore out of this expenditure with tags getting Rs. 700 crore. Thus far only half the garment and textile exports require bar coded labels. Apart from organised retail there is a large consumption of labels and packaging by segments such as sarees and textiles that may or may not be sold through organised retail. Pressure sensitive labels are used so extensively for these products that Gujarat, a traditional textile manufacturing state, also has a large number of label printers as well as coating machines that produce pressure sensitive label stock.

The Rs. 26,200 crore (in 2001-02) pharmaceutical industry is more packaging intensive than others and spends about 4.4% (Rs. 1152 crore) of its turnover on packaging. However a great portion of this is used for plastic and glass rigid containers (35%), foil and plastic blister packs (20%), cartons (25%) and corrugated shipping cartons (11.5%). Labels consumption is only 5% (Rs. 57 crore) of the total packaging budget. The Rs. 80,000 crore processed and value added food industry used the highest variety of packaging from rigid metal and glass to cloth, paperboard, film and foil. The overall packaging expenditure is 5% at Rs. 4000 crore. Of this self-adhesive labels are used extensively on metal, plastic, glass containers. Flexible shrink-wrap labels are also used on processed food products. Estimating the label component at 5% of the total packaging budget this would come to Rs. 200 crore

There are many tiny hurdles that hinder the growth of the label industry. The first is that the printing industry as a whole has been disorganised and fragmented, lacking investment in specialised components and tools. There is a dearth of technology developments, research and development, standardisation, testing and certifying, training facilities. Environment, health, safety, and best practices are also issues that need to be addressed if the industry is to address the needs of its customers.

Foreign direct investment and organised retail growth are seen as the drivers for the packaging and label industry as well.

|

|