Medical products have developed very well in the last few decades. With advances in the medical sector, medical packaging will also change considerably by 2020. Medical device and pharmaceutical packaging will become easier to use, less costly to produce, and provide much better protection. Some of the advances in medical packaging will include:

Interactive Medical Packaging

Over the coming decade, medical packaging will become more interactive which will require use of different materials. In USA, the FDA is encouraging that each primary package produced should carry an RFID tag with a unique code. In the future, it is projected that such tags will activate packaging line operations such as labeling, provide data for pedigree records, and help track and trace product through the supply chain to prevent counterfeiting and diversion. Intelligent shelves and storage cabinets will communicate with the tag permitting automated inventory tracking in hospital and retail settings. RFID tags along with printed electronics, nanotechnology and related nanomaterials will provide on-package tools to alert customers/consumers if a product is out of date, has been tampered with, or has encountered temperature abuse.

Medical Packaging with Braille Information

The European Union requires drug packaging to carry tactile information about product name, dosage, and expiration date to aid sight-impaired consumers (EU 2001/83/EC). It is expected that this legislation will spread beyond the EU over the coming decade. While embossing can provide this information, a glue dot dispensing system can apply 0.5 mm characters on any substrate.

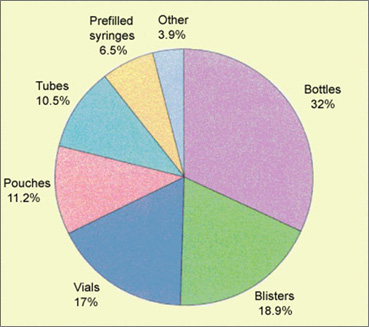

|

| Global Pharmaceutical Products Distribution in 2008 |

Type |

(%) |

Rigid |

57.5 |

Bottle |

32 |

Blister |

19 |

Prefilled Syringe |

6.5 |

Flexible |

42.5 |

Pouch |

11 |

Tube |

10.5 |

Vial |

17 |

Other |

4 |

Total |

100 |

| [Source: Institute of Packaging Professionals (IOPP)] |

By 2013, world pharmaceutical packaging demand is projected to increase 6.3% pa to US$62.3 bln, rising from last year’s US$45.9 bln as per a report by Feedonia. Developed countries of Western Europe, USA, and Japan will continue to account for more than 60% of this amount, although China will provide among the strongest growth opportunities. Behind the growth will be rapidly expanding pharmaceutical manufacturing capabilities and the phasing-in of an extensive government program designed to upgrade the quality and integrity of nationally produced medicines. Other major developing economies, India and Brazil will also evolve into fast-growing pharmaceutical packaging markets as drug- producing sectors are upgraded and diversified, especially in the area of generic ethical drugs.

USA will remain the largest consumer of pharmaceutical packaging as its advanced drug-producing sector introduces new, sophisticated therapies with specialized packaging needs. Western Europe demand will reflect upgraded government standards requiring unit-dose, high-barrier and anti-counterfeit packaging. Japan will remain a large, diverse consumer of pharmaceutical containers, closures and related accessories.

World demand for primary pharmaceutical containers will increase 6.1% pa through 2013 to US$38.2 bl. Prefillable inhalers and prefillable syringes will generate the fastest growth opportunities among all pharmaceutical packaging products based on performance advantages in drug delivery and the introduction of new bioengineered medicines. Plastic bottles will sustain the largest share of global demand based on low cost, versatility, availability, and ongoing quality and design improvements. Pharmaceutical blister packaging will generate favorable growth via unit dose, clinical trial, compliance, institutional, and over-the-counter drugs. Equipment upgrades, coupled with trends favoring unit -dose packaging, will also boost demand for pouches and strip packs. Parenteral vials, ampules, and IV containers will fare well in the global marketplace as new injectable therapies based on biotechnology and other advanced disciplines reach commercialization. By contrast, world demand for medication tubes and glass bottles and jars will expand at a below average pace due to competition from alternative containers.

Medical devices and supplies market in India is expected touch US$1.7 bln in 2010, growing at the rate of 23% annually in the coming years from the current Rs. 5750 crores, as per report by National Institute of Pharmaceutical Education and Research by (NIPER). Affordability by patients, increased awareness on health care, improved hospital infrastructure and the increased disease patterns are listed as the primary drivers boosting the growth medical devices industry. Free market environment, a developed industry and investment in health infrastructure are amongst other factors that the growth of high quality medical devices industry.

Among the segments in the medical devices market diagnostic equipment leads with Rs. 2000 crores, surgical equipment supplies worth Rs 1300 crores comes second and imaging and electronic treatment devices follow with Rs 1300 crores and Rs. 1000 crores respectively. The Indian medical equipment market is dominated by the medical instruments and appliances used in specialties such as ophthalmic, dental and other physiological classes. This segment accounts for 26% of the total market followed by orthopedic/ prosthetic goods segment accounting for 19% of the total market. Medical supplies such as bandages and disposables such as syringes, needles and catheters together constituted 21% of the total market. The other equipment which are in demand are high end speciality electro medical equipments that accounted for 11% of the total market. X-ray apparatus accounted for 10% of the total market. Another high growth segment in the medical devices industry is diagnostic kits. Diagnostic kits have a growth rate of 30% and a market size of US$133 million in 2005. They include the reagents and the medical kits. Imports constitute over 50% of the market. Most imported products have high gross margins. Currently, the high value imported products include cancer diagnostic, medical imaging, ultrasonic scanning, plastic surgery equipment and polymerase chain reaction technologies. However, the market is becoming increasingly competitive due to low entry barriers (for MNCs), an increasing number of players and an expanding consumer base. The medical devices market for exports from India is estimated around US$509 mln with a CAGR of 22.15%. The exports mainly consist of dental instruments, surgical items and other laboratory equipment. Despite strong growth rates, the market remains disproportionately small, ranking among the top 20 in the world, but with a very low per capita spending.

Major issues and constraints found to cripple the industry are India’s dependency on imports for supply of medical devices, strict industry regulatory environment, low level of healthcare insurance and low levels of healthcare facilities and awareness especially in rural areas. Indian medical devices supply is heavily dependant on the imports from other countries like the US, Japan, the UK, France, Finland, Germany, etc. It is estimated that around 50% of India’s medical devices sales is through imports. Domestic production consists primarily of low technology products (like surgical textiles and other medical supplies), whereas the demand for high technology devices is met predominantly by imports. |

|