|

The year 2004 was a tumultuous year - a year that saw tremendous increase in price of oil and almost all petrochemicals. In particular, the second half of this year witnessed escalating prices that halted a solid growth in nascent stages just as the global economy was on the path to recovery. Initially the prices of polymers did not increase along with rise in feedstock prices, but as the months continued with higher feedstock prices, the prices of polymers inevitably increased. Further growth of petrochemicals in 2005 will be decided by the stability of feedstock prices. The plastic processor was squeezed at two ends - by the raw material suppliers at one end and the end users at the other. The price increases adversely affected the profitability of plastic converters while maintaining some growth, as the users were not willing to pay more to the processors.

However, the growth of plastics, though unabated, has definitely seen a drop to some extent. While the global growth of plastics may not be as high as 5-6% as envisaged earlier, it should definitely be more than 4%. This can be mainly attributed to some very positive trends observed in Asia, particularly in China as well as in India. In fact, the Asian region overall is expected to perform much better. North America as well South America would also show positive growth. While Europe may observe modest growth, Russia is expected to do very well. Japan, for the second year in row, has recorded positive economic growth. The global economy definitely is expected to show a growth of about 3.5-4%. Oil price stability could definitely push economic growth to 5% in 2005 - this would increase the growth of polymers beyond 5%.

The Middle East region is building up its strength in the petrochemical sector to take advantage of availability of cheaper feedstocks and will continue to consolidate it's position in the next few years. As of now, Saudi Arabia is leading in petrochemical projects, but other countries in the region are also setting up new projects. The Gulf region will become the world's largest producer as well as exporter of petrochemicals and plastics by 2005. The exports of ethylene-based products are forecast to grow from 5.7 million tons in 2001 to more than 11 million tons in 2006, while exports of propylene-based products are expected to increase from 450,000 tons in 2001 to 1.5 million tons in 2006. Annual exports of all petrochemical products from the AGCC are already above 30 million tons, expected to increase to over 40 million tons by the end of 2005.

What is very interesting is that the Middle Eastern companies are now looking for setting up projects in China. For instance, Saudi Arabia Basic Industry Corp. - SABIC is in talks with China Petroleum & Chemical Corp. (SNP), or Sinopec Corp., on taking a stake in a major ethylene project in northern China's Tianjin city. Only time will tell whether such joint venture activity will increase in future. We strongly believe that the petrochem manufacturers in the Middle East cannot afford to lose the inherent advantage of cheap feedstocks.

Since Asia is likely to emerge as the largest consumer of petrochemicals and plastic products very soon, the trend of the petrochemical industry shifting from North America and Europe to the Middle Eastern and Asian regions will continue. No wonder that the North American and European majors have been constantly consolidating. Some of the reorganizations that have either taken place or are likely to emerge in 2005 are:

· Basell Polyolefins, the largest producer of PP is put on the block. Its ownership could change in future.

· Bayer has separated its polymer group in the form of Lanxess in order to concentrate on Life Science.

· BP and Nova have formed a merger of their styrene businesses across Europe. The new joint venture will include 7 plants with total capacity of about 1.2 million tons of Polystyrene.

· BP will buy Solvay's share of their joint venture in HDPE involving about 2.5 million tons of HDPE.

· Borealis is selling its Spain plant to Repsol in order to concentrate on its activities in Northern Europe.

· Italian PET manufacturer Gruppo Mossi & Ghisolfi is planning to construct 450 KT/annum PET plant in South America to take advantage of excellent growth and lack of adequate supply.

Overall the global plastics industry seems to be quite positive. This was reflected at the recently held K 2004 fair at Dusseldorf in Germany. Ascompared to the one held in 2001, not only was the number of exhibitors more at this fair, but the number of visitors was also more.

As expected, commodity plastics will dominate the volumes.

Among the commodity plastics, Polyolefins will continue to grow better than PVC and PS.

Lower cost and higher capacity of LLDPE are responsible for its spectacular growth - LLDPE has been growing the best with almost 6.5% and has superceded PP in growth.

PP is likely to grow at 5.5% and HDPE will grow at 5%.

On the other hand, LDPE will lose its share and will record negative growth.

Polycarbonate seems to face capacity constraint, particularly after its growth in the CD/DVD area.

Bio degradable polymers have more than 15% growth from a smaller base.

Nanoclays or fillers are likely to grow well in the future. Automotive and packaging sectors have seen a good growth of nanocomposites.

Another area that has bright future is wood composites. While the extruded wood composite products had an earlier breakthrough, injection moulding of wood composites has started growth in 2004. Of course the extruded products will continue to have a major share.

Metallocene polymers are growing more in the specialty area, their growth is restricted because of higher cost. Only LLDPE has grown quite well in the metallocene polymers. PP still continues to lag behind.

The Asian polymer manufacturers are in an upbeat mood and are poised for expansion or an increase in capacities by debottlenecking, etc. After all; they require to fulfill the insatiable demand of their economically growing population.

Reliance Industries is increasing PP capacity from 1.2 million tons to 1.4 million tons with the addition of a new Unipol plant at the Jamnagar refinery site.

PVC capacity is to be increased by 200 KT at the Dahej site of IPCL.

Reliance Industries has commenced production at the Nocil plant of EVA(15KT). It proposes to start UHMDPE (2KT) as well slurry HDPE (60KT) plants, shortly.

Interestingly, a new alternative to Reliance-IPCL in the area of PE and PP is likely to emerge by 2007, when the largest oil refining Government owned company Indian Oil Corp. will set up a huge naphtha cracker at Panipat in North India along with downstream projects of 600KT of PE and 600KT of PP. Indian Oil Corp. has obtained Basell technologies for slurry process to manufacture HDPE (300 KT) and Spheripol process for PP. LLDPE/HDPE swing project will have solution process technology from Nova.

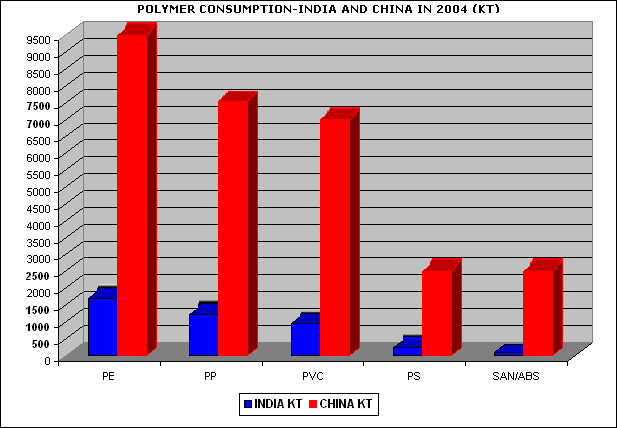

It will not be very surprising that the Asian region will constitute 50% of the global consumption; and possibly 75% of this consumption would be met from their own capacity. While all Asian countries will continue to grow, China and India with their large population base would almost constitute 75% of the Asian demand. China’s juggernaut on the plastics manufacturing continues, but India is also catching up with almost 8-10% overall growth of plastics in 2004 as well as 2005. While China is growing very well not only in the commodity polymers but also in ETP, Indian growth still continues only in commodity polymers. In fact, ETP constitutes only less than 100KT out of almost 4.5 million tons in 2004.

The estimated consumption of polymers in China during 2004 was:

| Polymer consumption in China in 2004 |

Polymer

|

KT

|

% |

PE

|

9500 |

33 |

| PP |

7500 |

26 |

| PVC |

7000 |

24 |

| PS |

2500 |

9 |

| ABS |

2500 |

9 |

| Total |

29000 |

100 |

India has grown by about 10% in 2004, but actual consumption is lower when compared to China. With polymer growths quite similar in both the countries, India despite its huge population, will always be a distinct second in Asia. It cannot catch with the demand/consumption of plastics in China.

However, both these countries will dominate the global markets. They will influence the capacity and supply situations in the future. China, because of its huge demand will continue to outsource polymers from the Middle East. Supply in India on the other hand, is surplus for the last few years and India continues to export almost half a million tons of polymers every year, predominantly to China.

The estimated consumption of polymers in India during 2004 was:

| Polymer consumption in India 2004 |

|

Polymer

|

KT

|

% |

LDPE/EVA

|

250 |

5 |

LLDPE

|

525 |

12 |

HDPE

|

925 |

20 |

|

Total PE

|

1700 |

37 |

| |

|

|

PP

|

1200 |

26 |

|

Total Polyolefin

|

2900 |

64 |

| |

|

|

PVC

|

950 |

21 |

PS

|

225 |

5 |

PET

|

|

|

Film

|

120 |

3 |

Bottle

|

80 |

2 |

PET

|

200 |

4 |

SAN/ABS

|

85 |

2 |

|

Total Commodity

|

4360 |

96 |

| |

|

|

|

ETP

|

|

|

Polyamide

|

30 |

1 |

Polycarbonate

|

40 |

1 |

Polyacetal

|

8 |

0 |

PET/PBT

|

5 |

0 |

Others

|

2 |

0 |

| |

|

|

|

ETP

|

85 |

2 |

| |

|

|

Thermoset

|

100 |

2 |

Total

|

4545 |

100 |

Total (Rounded)

|

4550 |

|

| |

|

|

www.plastemart.com team wishes you a very happy and prosperous 2005 |

|